As some of you may know, The Chancery Daily’s flagship publication is a daily email trade publication, mostly intended for lawyers and other specialists who practice in or around the Delaware Court of Chancery and the Delaware Superior Court’s Complex Commercial Litigation Division, the lot of whom we sometimes refer to collectively as the “Delaware corporate law community of interest.”

Since last year happened, the Delaware Court of Chancery’s involvement in the national media circus known as Twitter v. Musk dramatically expanded the scope of who considered themselves an “interested” member of the Delaware corporate law community. Accordingly, TCD expanded its product offerings to include this Substack, which provides much more commentary and much less legal and praxis minutiae than our main publication. Here, we attempt to serve a wide swathe of both lawyers, law nerds, and lay persons who have all manner of varying degrees of interest in the Court of Chancery and Delaware corporate law, at a much lower price point. It’s all — always — a work in progress, and we certainly get it right sometimes and other times fail spectacularly. With the recent, further expansion into popcorn-munching 🍿 APE-AMC aficionados, the circle expands ever further. It’s a big tent 🎪 and we appreciate everyone’s patience while we provide information that serves all our contingents. If it’s not your turn today, it will be soon. And we always welcome feedback or requests for content. Yesterday’s Q&A on AMC was a direct response to reader inquiries (and some absolutely bonkers %*!& posted on the internet).

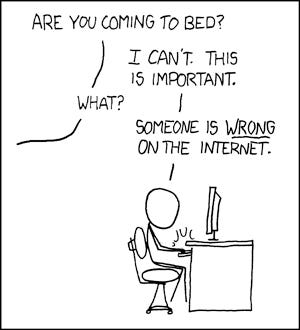

(Sidenote, yes it’s true, there is always an xkcd, and this one is, in fact, about me.)

Anyway, in addition to summarizing and analyzing all of the opinions and orders that come out of the courts on a daily basis, our legal publication also provides quotidienne (though certainly not pedestrian) commentary and legal analysis. Although it may not appeal to stockholders who eat popcorn for breakfast, please permit me the interruption of cross-posting one such piece here on Substack.

The below ran in yesterday’s edition and I think it is a sweet and appropriate tribute to the Court of Chancery. It draws a parallel between the handling of the spate of §205 SPAC-related actions to stabilize questionable capitalization structures in the wake of last year’s Boxed ruling (aka, The SPAC Attack) with the case of the errant-sent Citibank-Revlon wire, which you may have heard about in mainstream media.

For subscribers to both publications, you have my never-ending gratitude in general and thank you in the specific here for the indulgence pour le dire deux fois. You are the real OGs and you make all of this possible. In a very literal sense, we couldn’t do any of it without you and your financial support. And if you’re a lawyer and don’t yet subscribe to The Long Form, ask your law librarian to add you to your firm’s subscription! And if your firm doesn’t have a subscription to The Chancery Daily, ask them to set one up.

Members of the Delaware corporate law community of interest -- particularly those who do not use cosmetics -- almost certainly understand Revlon to mean Revlon, Inc., et al. v. MacAndrews & Forbes Holdings, Inc., Nos. 353, 354, 1985, opinion (Del. Mar. 13, 1986). In fact, Wednesday’s Chancery Salvo announcing the Chancellor's decision in In re Mindbody, Inc. Stockholder Litigation, C.A. No. 2019-0442-KSJM, memo. op. (Del. Ch. Mar. 15, 2023) calls it the "iconic Revlon decision" no less than three times.

But there is another Revlon, perhaps better known to those in areas adjacent to Delaware corporate law, and known to TCD, though we haven't previously discussed it: In re Citibank August 11, 2020 Wire Transfers, C.A. No. 20-6539-JMF, opinion (S.D.N.Y. Feb. 16, 2021). There, mistakes were made:

On August 11, 2020, Citibank N.A., acting in its capacity as Administrative Agent for a syndicated term loan taken out by Revlon, Inc., intended to wire approximately $7.8 million in interest payments to Revlon's lenders. Instead, it made one of the biggest blunders in banking history: It mistakenly wired, in addition to Revlon's $7.8 million, almost $900 million of its own money as well. The resulting payments equaled -- to the penny -- the amounts of principal and interest that Revlon owed on the loan to its lenders. The question in this case is whether Citibank is entitled to get the money back or whether the lenders are allowed to keep it.

As to the question presented, the District Court concluded -- under the case law authority of Banque Worms (not as aptly-named a controlling authority suggestive of its subject matter as Sugarland, but still somewhat suggestive) -- that Citibank was stuck with its billion-dollar "fat finger" mistake. (We jest . . . the District Court expressly "distinguishe[d] Citibank's mistake here from a so-called 'fat finger' mistake" -- but did acknowledge that it was indisputably a mistake.) TCD refrains from a detailed review of the District Court's 100+ page decision, but notes that Banque Worms was named for its founder, rather than the decomposing phylum Annelida.

The District Court's decision was ultimately reversed on appeal in Citibank, NA v. Brigade Capital Management, LP, et al., No. 21-487, opinion (2nd Cir. Sept. 8, 2022). In a thoughtful concurring Opinion, Second Circuit Judge Michael H. Park lamented the consequences of the undisputed mistake:

When people receive money by mistake, the law usually requires them to give it back. This commonsense rule allows transferors to reclaim property that rightfully belongs to them -- whether misdirected funds, an accidental overpayment, or a credit to the wrong bank account. An exception to the general rule can sometimes protect a recipient who was owed the mistakenly paid money. . . . But here, Defendants had no such claim . . . . Allowing them to keep that money would turn equity on its head and topple the settled expectations of participants in the multitrillion-dollar corporate-debt market. It would also be brutally unfair.

In my view, this is a straightforward case that many smart people have grossly overcomplicated and that we should have decided many months ago. . . .

. . . Citibank filed suit within six days of its mistake, the district court conducted a full bench trial and published a detailed opinion six months later, and we -- at least nominally -- expedited consideration of this case. But it has now been nearly a year since oral argument and over two years since the mistaken transfer. In that time, Citibank has lost of tens of millions of dollars in interest alone on its frozen funds. Businesses and their lenders have scrambled to negotiate various new terms into their agreements. And the parties, as well as the market at large, have had to manage the uncertainty our indecision has caused them.

This delay has had dire repercussions for Revlon, the company at the center of this case. . . . Revlon cannot secure additional senior financing without the consent of a majority of the 2016 Term Creditors, but for the past two years, no one has been able to agree on who would constitute such a majority. So Revlon 'effectively has had, since August 11, 2020, no 2016 Term Loan counterparty with which it can negotiate,' and on June 15, 2022, Revlon filed for Chapter 11 bankruptcy. Revlon, a century-old American company, cited not just its business troubles, but also 'significant and unprecedented difficulty in managing its capital structure out of court.' That difficulty, Revlon said, stemmed from the fact that 'the Second Circuit ha[d] not yet issued a decision' in this case.

It's hard to imagine a starker counterpoint to the way this "other" Revlon case was handled than to recap how the recent spate of § 205 actions have been deftly overseen, managed, and brought to final dispositions. The Capital "O" Opinion, In re Lordstown Motors Corp., C.A. No. 2023-0083-LWW, opinion (Del. Ch. Feb. 21, 2023) followed less than one month after Lordstown filed the first of many similar petitions on January 26, 2023, and less than two months after uncertainty was created by the issuance of Robert Garfield v. Boxed, Inc., C.A. No. 2022-0132-MTZ, memo. op. (Del. Ch. Dec. 27, 2022).

To date, there have been fifty-two such post-Boxed SPAC-§ 205 petitions filed and final judgment has been rendered in thirty-eight. The remaining fourteen petitions are pending scheduled hearing days on March 17th and 29th for what we assume will be continued orderly disposition.

In four cases, oppositions have been filed by stockholders. In three of those cases, the petitioners responded to the oppositions and the Court entered judgment over the opposition. In the fourth instance, the opposition was subsequently withdrawn and the case is pending its hearing.

It has been said that "justice delayed is justice denied," and in spite of the incredible burdens facing the Court on a daily basis, requiring all manner of creative solutions, it's easy to see how one might argue that no other court could provide as certain, prompt, complete, or efficient justice as this court of equity.

Related Documents:

In re Hyliion Holdings Corp., C.A. No. 2023-0176-LWW, opposition (Del. Ch. Feb. 21, 2023)

In re Matterport, Inc., C.A. No. 2023-0201-LWW, opposition (Del. Ch. Mar. 2, 2023)

In re Quantum-Si Inc., C.A. No. 2023-0251-LWW, opposition (Del. Ch. Mar. 3, 2023)

In re Stem, Inc., C.A. No. 2023-0270-LWW, opposition (Del. Ch. Mar. 9, 2023)

If you enjoy our Substack, please share it. It truly does make a difference. It’s not a given that this is something we can always keep doing in addition to our daily legal publication, especially without ongoing financial support, and subscriptions depend heavily on word of mouth. Your recommendations to friends, family, and followers are meaningful.

If you are not a paid subscriber, please consider becoming one, if it’s within your means to do so. We do not force paywalls on all of our content, but because we do not do so, many people only enjoy our free content without supporting our ongoing concerns. If you cannot afford to subscribe to any of our products, please help us out by sharing our content on social media, because every share matters and this Court deserves to be celebrated. 🎉

P.S. Thanks to friend of TCD Professor Eric Chiappinelli of Texas Tech Law School for dubbing this a “paean” — although I’d love to take credit for such a perfect mot juste, ‘twas his.

P.P.S. Another friend of TCD who also happens to be a Professor and also happens to be named Eric, but is in fact Professor Eric Talley of Columbia Law School, was cited in the above-mentioned 2nd Circuit opinion, concurrence at pg. 28: “It should come as no surprise that the opinion below has roiled the market for commercial debt, to the point where the type of contract clause overriding the district court’s rule already has its own name: “Revlon blocker.” See Brief of Professors of Law and Economics as Amici Curiae at 27; Eric Talley, Discharging the Discharge-for-Value Defense, 18 N.Y.U. J.L. & Bus. 147, 154 (2021) (reporting a “veritable flood” of 150–200 such Revlon blockers per month following the decision, compared to exactly one contract affirmatively adopting the district court’s rule).”